We are proud to announce that Ayobami-Akanbi Fareed has been appointed as our Head of Operations & Strategy. Fareed is a veteran of Africa’s crypto and fintech scene, known for his visionary approach to marketing, education, and user growth in the emerging markets. His arrival comes at a pivotal moment as Bankii accelerates its mission to empower financial inclusion in Africa through blockchain-powered solutions. With Fareed on board, we are confident in taking the next steps toward our bold vision.

Fareed’s career is a testament to his passion for the Web3 ecosystem. Early on, he joined FTX Africa’s expansion team, focusing on content and community initiatives. In that role, he helped educate and onboard users across the continent , from university students in Nigeria to crypto communities in Ghana, Kenya, and South Africa. FTX was instrumental in Africa’s crypto boom, processing billions of dollars in local transactions each month and Fareed played a key part in making that platform accessible to new users.

In addition to his startup work, Fareed has been active in Web3 media. He has authored Hundreds of articles for crypto publications and collaborated with web3 media platforms helping to deliver unbiased blockchain news and education. His articles on topics like African crypto regulations have earned him a reputation as a clear, insightful communicator. In every role, Fareed has demonstrated exceptional content strategy and go-to-market skills.

Importantly, Fareed has also contributed directly to Bankii’s journey. Prior to this promotion, he served as Bankii’s Content and Communication Manager, aligning our messaging with the needs of African users. This insider perspective on Bankii’s platform and mission means he can hit the ground running in his new leadership role.

We’re thrilled to have Fareed helm our operations and strategy because his experience matches Bankii’s ambitions perfectly. Bankii’s founding mission is to solve financial inclusion and cross-border payment challenges in emerging markets through blockchain. Fareed’s deep knowledge of these markets and proven track record will help accelerate our growth. He understands firsthand why Nigerians, Ghanaians, Kenyans and South Africans are adopting crypto – often due to high inflation and limited banking access, and he knows how to communicate solutions effectively in these contexts.

Fareed will be instrumental in refining Bankii’s go-to-market strategy. His expertise in content and campaign execution means Bankii’s messaging will be sharper and our user education even stronger.

Together with the Bankii team, he plans to leverage partnerships and local insights to build brand trust and user bases in target markets like Nigeria, Ghana, Kenya and South Africa. His appointment also signals Bankii’s commitment to Web3 leadership, blending visionary crypto strategy with real-world fintech usability.

Looking ahead, Fareed is focused on expanding Bankii’s footprint across Africa and beyond. He shares our vision of bringing more people into the digital economy. This means not only growing our user base, but also educating communities about decentralized finance (DeFi) and how it can preserve wealth and facilitate affordable remittances. By customizing Bankii’s offerings to local needs, he aims to make our hybrid finance solutions as impactful as possible.

Bankii’s strategy is to roll out products like the Bankii Card and digital asset services in markets with rapid crypto adoption. Under Fareed’s leadership, we will continue to innovate, enhancing the Bankii app, launching new features, and strengthening partnerships , so that anyone, anywhere can manage and grow their money safely and seamlessly. His forward-thinking approach to operations and strategy will be key to scaling those efforts.

As Fareed steps into his new role, Bankii is more energized than ever. His arrival marks the beginning of an exciting chapter. Together, we look forward to breaking new ground in crypto financial inclusion across emerging markets

Tech & Web Associate

Location: Remote (Africa Preferred)

Employment Type: Contract to Full-Time (3-month probation)

Bankii is a digital-first financial platform empowering Africans and emerging market communities with tools to transact globally, and access fair finance. As we scale our product ecosystem and community, we’re looking for a capable and resourceful Tech & Web Associate to strengthen our internal technology and website infrastructure.

The Tech & Web Associate will serve as the go-to technical lead for all things web, platform, and digital tools across the Bankii ecosystem. This role requires a strong blend of technical problem-solving, SEO knowledge, and the ability to implement user-facing features like, landing pages,chatbots and performance optimizations. You will collaborate closely with the Operations, Marketing, and Product teams to ensure our digital infrastructure supports our brand, growth, and community goals.

Web & Platform Maintenance

SEO & Performance Optimization

Feature Implementation

Cross-Functional Support

Submit your resume or portfolio, along with a short note (email) on why you’re a fit for this role and one suggestion you’d make to improve https://bankii.finance.

Send applications to: [email protected]

We’re thrilled to share that the long-awaited $BKNY token claim is now officially LIVE! This marks a major milestone in our journey, and we’re excited to begin this next phase with you , our valued community and early supporters.

Whether you participated in our presale or joined us via IEO, this post will walk you through how to claim your tokens, what to expect next, and how to get support if needed.

If you participated in the Bankii IEO on P2B Exchange, claiming your tokens is simple:

➡️ Log into your account on P2B Exchange

➡️ Navigate to your dashboard

➡️ Follow the instructions to claim your $BKNY tokens directly

This process is now live and fully active — your tokens are ready for collection!

We’ve already started distributing tokens to all eligible presale participants who submitted valid SPL-compatible wallet addresses. If you’ve received your tokens , welcome aboard .

However, if your tokens haven’t arrived, it could be due to:

But don’t worry — we’ve got you covered.

If you haven’t received your tokens yet:

Please note:

❌ Centralized exchange addresses are NOT supported.

✅ Ensure your wallet is non-custodial and SPL-compatible for Solana-based tokens.

We’re just getting started. Here’s what’s coming up:

Launching the $BKNY token has been a journey, and it wouldn’t be possible without your support, feedback, and belief in what we’re building.

We’re laying the foundation for a more inclusive financial future , and you’re part of it from Day One.

Big things are coming.

Let’s build together. 💙

Team Bankii

The Ibom Blockchain Summit in Uyo, Akwa Ibom State, Nigeria, was a gathering of innovators, builders, and thought leaders in the blockchain and fintech space, all converging to discuss the future of decentralized technology in Africa. Bankii Finance was proud to be a collaborator at this prestigious event, further solidifying its commitment to driving financial inclusion and blockchain adoption across the continent.

The summit served as a crucial platform for dialogue on blockchain technology’s role in Africa’s financial transformation. With Nigeria being one of the fastest-growing hubs for cryptocurrency adoption, hosting such a summit in Uyo, a rising tech hub, was a strategic move to spread awareness and drive regional participation in the evolving digital economy.

The event attracted key players from across the blockchain industry, government officials, fintech entrepreneurs, developers, and blockchain enthusiasts, all eager to share insights on leveraging decentralized technologies for economic growth and financial accessibility.

As a forward-thinking fintech brand, Bankii Finance played a crucial role at the summit by engaging with industry experts, fostering collaborations, and amplifying conversations around the practical applications of blockchain in the African financial landscape.

Our participation included:

The Ibom Blockchain Summit underscored several critical points about Africa’s blockchain future:

Our participation at the Ibom Blockchain Summit reaffirms Bankii Finance’s dedication to building Africa’s financial future. As we expand our presence across the continent and into the Middle East, we remain committed to:

The Ibom Blockchain Summit was an inspiring milestone in Bankii Finance’s journey. As we continue to engage with Africa’s growing blockchain community, we remain steadfast in our mission to create a more inclusive, efficient, and innovative financial ecosystem for the continent and beyond.

Follow Bankii Finance for more updates on our initiatives, events, and groundbreaking solutions in the fintech and blockchain industry.

Are you a strategic thinker with a talent for forging powerful partnerships? Do you have experience building alliances that drive business growth, marketing exposure, and technical collaboration? If so, Bankii Finance wants you on our team!

As we continue our mission to revolutionize financial services across the world, we are looking for a Partnership Manager to help us secure and manage impactful partnerships in the business, marketing, and technical domains.

This is a unique opportunity to join a fast-growing fintech company and play a key role in expanding our network, strengthening our ecosystem, and increasing our brand visibility.

Bankii Finance is at the forefront of redefining financial inclusion and freedom through blockchain and crypto-powered solutions. We are focused on making financial transactions seamless, secure, and accessible to everyone. From cross-border payments to crypto debit cards and a gamified rewards ecosystem, we are building the future of finance.

To accelerate our growth and expand our reach, we are actively seeking strategic business, marketing, and technical partnerships—and we need a Partnership Manager to lead this charge!

Location: Remote

Job Type: Part time

Department: Business Development & Strategic Partnerships

Key Responsibilities:

We’re looking for a highly motivated, results-driven professional with a strong understanding of the crypto and fintech space. The ideal candidate should have:

✅ 2+ years of experience in business development, partnerships, or a related field.

✅ A strong network in fintech, crypto, blockchain, or digital payments.

✅ Excellent communication and negotiation skills to close deals effectively.

✅ Proven ability to manage multiple partnerships across business, marketing, and technical sectors.

✅ Strong understanding of blockchain, DeFi, and Web3 ecosystems.

✅ Ability to work independently and drive initiatives in a fast-paced environment.

✅ Experience working with international teams and remote environments.

⭐ Experience working with crypto payment providers, exchanges, or Web3 projects.

⭐ Familiarity with growth marketing strategies and influencer collaborations.

⭐ Prior experience in technical integrations or API-based partnerships.

⭐ Previous track record of securing high-impact partnerships in fintech or crypto.

🌍 Be Part of a Global Movement: Help shape the future of crypto payments and financial freedom in emerging markets.

💰 Competitive Compensation: Enjoy a rewarding package based on your experience and performance.

🚀 Career Growth: Work in a fast-growing company with endless opportunities for growth.

🕐 Flexible, Remote Work: Join a dynamic, fully remote team with a culture of innovation and autonomy.

🤝 Work with Industry Leaders: Collaborate with top players in crypto, fintech, and blockchain.

🔹 Step 1: Prepare your CV and cover letter highlighting your experience in business development, partnerships, and crypto/fintech.

🔹 Step 2: Send your application to [email protected] with the subject line: “Partnership Manager Application – [Your Name]”.

🔹 Step 3: Shortlisted candidates will be invited for an interview and case study assessment.

Are you ready to take Bankii Finance to the next level through powerful partnerships? Apply now and become a key driver of our expansion strategy.

Let’s shape the financial future together!

Are you passionate about shaping Africa’s financial future? Do you have a talent for forging impactful partnerships and driving meaningful conversations? Bankii Finance is growing, and we’re looking for dynamic Business Developers in Nigeria, Ghana, and Kenya to help us expand and thrive in these markets!

At Bankii, we’re redefining financial freedom across Africa and beyond. By leveraging crypto and blockchain technology, we’re making cross-border payments seamless, secure, and accessible. As part of our mission, we’re seeking talented individuals to join us in building a connected, empowered financial ecosystem.

As a Business Developer at Bankii, you’ll be at the forefront of our growth strategy. Your responsibilities include:

We’re looking for individuals who:

Know someone who fits the bill? Share this opportunity with them! Let’s build a buzzing team ready to lead Africa into a new era of financial empowerment.

The wait is finally over! We are thrilled to announce the launch of the Bankii WebApp and Android App in beta. This milestone marks a significant step in our mission to revolutionize financial freedom across Africa and beyond. With these platforms now live, users can start experiencing the future of seamless, secure, and efficient financial services at their fingertips.

But this is just the beginning. In the coming months, we’re rolling out even more features, including iOS support, crypto debit card orders, and other exciting updates designed to enhance your financial journey.

At Bankii, we understand the challenges that come with managing finances in a fast-evolving digital world. Whether you’re sending or receiving money, swapping currencies, or exploring crypto solutions, our WebApp and Android App are designed to make your experience simple and hassle-free.

While our WebApp and Android App are live and buzzing, we’re just getting started. Here’s what’s on the horizon:

For our Apple enthusiasts, we’re excited to announce that the Bankii iOS App is in the works and will be launching soon. Stay tuned for updates!

Imagine spending your crypto seamlessly, anytime, anywhere. Our Bankii Crypto Debit Card is coming soon, enabling users to convert crypto to local currencies in real-time and shop globally with ease.

We’re continually improving the platform based on your feedback. Expect more features that will make managing your finances even more intuitive and efficient.

By joining the beta version of our platform, you’ll have early access to the tools shaping the future of finance in Africa.

Your feedback is invaluable. As a beta user, you’ll play a critical role in helping us refine the platform to meet your needs.

Get familiar with the platform now and be ready to leverage upcoming features like our iOS app and crypto debit cards as soon as they launch.

Bankii isn’t just a platform; it’s a movement. With over 4,000 members in our Telegram community, we’re building a hive of users passionate about financial empowerment. By joining our community, you’ll:

The launch of our WebApp and Android App in beta is a significant milestone, but the journey has only begun. As we continue to roll out exciting features, we’re committed to ensuring that every step we take brings us closer to delivering the ultimate financial platform tailored for Africa and beyond.

Thank you for your support and trust in Bankii. Together, we’re not just building a platform; we’re shaping the future of finance.

Ready to experience the buzz? Access the beta version now and take the first step toward financial freedom.

At Bankii, we’ve always believed in doing things the right way, not the rushed way. This philosophy guides our approach to innovation, community-building, and financial empowerment. Today, we’re thrilled to share exciting updates about our much-anticipated Bankii Token ($BKNY) launch. While originally slated for this year, we’ve made the strategic decision to schedule the public sale for Q1 2025.

Here’s why—and why this timing ensures $BKNY becomes a cornerstone of Africa’s financial revolution.

$BNKY is more than just a token; it’s the lifeblood of the Bankii ecosystem. Rooted in transparency, accessibility, and innovation, $BKNY will empower users across Africa and beyond to unlock unique financial opportunities, including:

$BNKY isn’t just a token—it’s the foundation of a movement to reshape how Africa interacts with digital finance.

We understand the anticipation surrounding $BKNY and the eagerness of our community to participate in its public launch. However, at Bankii, we prioritize value over haste and believe in delivering more than just promises—we deliver impact. Here’s why we’ve decided to push the launch to Q1 2025:

We’re in the final stages of releasing the Bankii Web App, which will be a comprehensive platform for managing your finances, accessing our services, and utilizing $BKNY.

We’ve partnered with Cyberscope, a leading auditing firm, to ensure $BKNY is secure, transparent, and ready for public use. This extra time allows us to fine-tune every aspect of the token, from smart contracts to platform integration, minimizing risks for our community.

A rushed launch might generate short-term excitement but can lead to long-term challenges. By aligning the $BKNY launch with the release of our web app, we’re ensuring a cohesive experience where every part of the ecosystem supports and enhances the other.

The delay isn’t a setback—it’s an opportunity for you to be part of a stronger, more integrated Bankii ecosystem. When $BKNY launches in Q1 2025, you can expect:

This strategic move ensures that $BKNY isn’t just another token; it’s a token with purpose, utility, and a clear role in your financial future.

We’re grateful for the unwavering support and excitement from the Bankii Hive. You’ve been the driving force behind our growth, and your trust inspires us to keep building with integrity.

As we count down to Q1 2025, here’s what you can look forward to:

The future of finance in Africa is brighter than ever, and $BKNY is set to play a pivotal role. By delaying the launch to ensure quality and utility, we’re laying the groundwork for a token that truly delivers on its promises.

Ready to be part of the revolution? Stay connected with the Bankii Hive for updates, sneak peeks, and opportunities to engage. Together, we’re shaping Africa’s financial future—one step at a time.

Join the Bankii Community Today

🌍 Bankii Token: Building for Africa. Building for You.

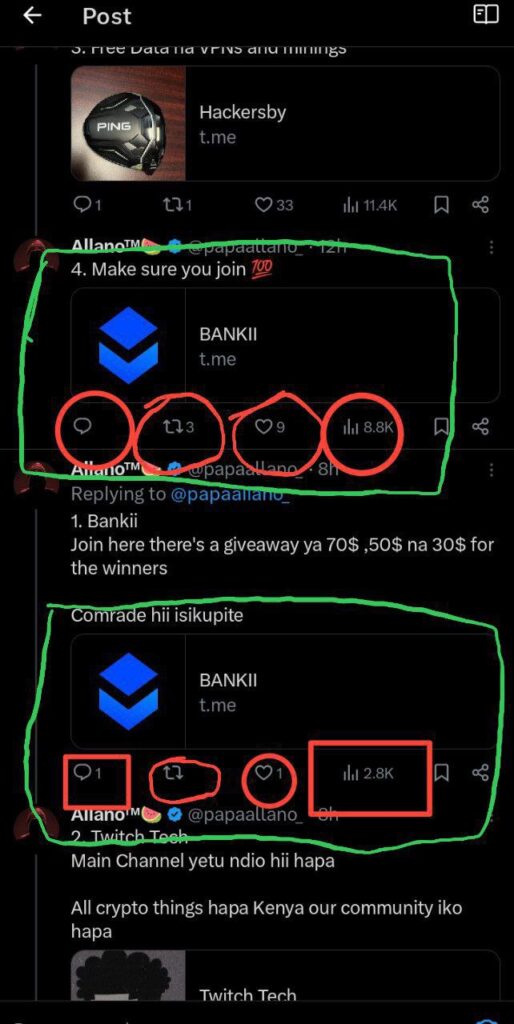

At Bankii, we believe in the power of community and collaboration to shape Africa’s financial future. Over the past two weeks, the Bankii Hive Referral Campaign created an electrifying buzz, bringing together a vibrant mix of crypto enthusiasts, innovators, and dreamers from across the continent and beyond. Today, we’re excited to share the results, celebrate our winners, and reflect on this milestone in our journey.

The Bankii Hive Referral Campaign aimed to grow our Telegram community while rewarding participants for their enthusiasm and efforts. Starting with just 1,200 members, our community has now soared past 4,000 members—a testament to the passion and belief people have in Bankii’s mission to redefine financial access for Africa.

We saw participants actively engaging, spreading the word, and bringing their networks on board. Together, we achieved something incredible, and this growth lays a solid foundation for the future.

🏆 Congratulations to our top referrers!

🥇 First Place: @Mr_sly3

🥈 Second Place: @Stoney_t

🥉 Third Place: @Leakey_ke

These incredible individuals went above and beyond to grow the Bankii community. Each has won exciting rewards, including Bankii swag and exclusive perks. Winners are requested to send their Solana wallet addresses and shipping details to @Web3Legend_1 for prize collection.

In addition to the top referrers, we hosted a raffle for participants with at least one valid referral. Congratulations to our lucky raffle winners who will receive exclusive Bankii swag: 🧢👕

🏅 Winners are kindly requested to send their shipping addresses to @Web3Legend_1 to claim their prizes.

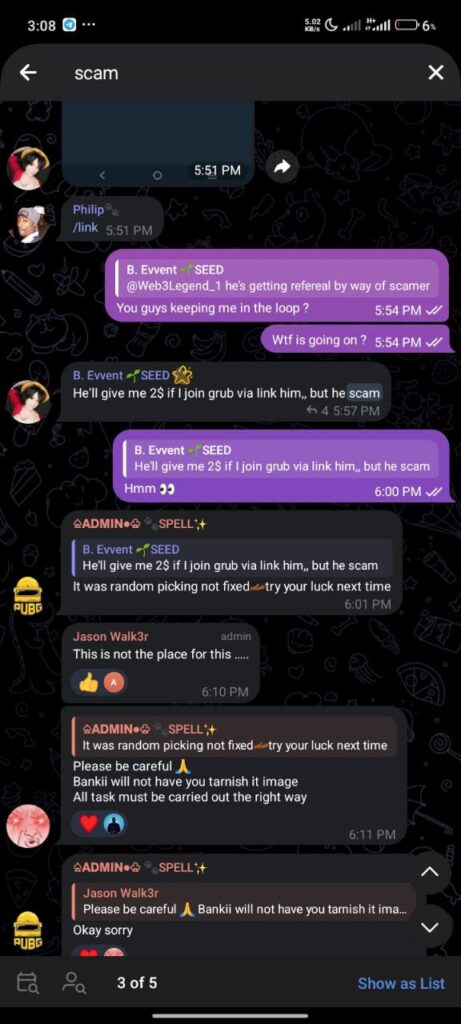

While the campaign was an overwhelming success, maintaining fairness was crucial. Unfortunately, some participants were disqualified for violating the campaign rules. Disqualifications were based on:

Invites coming in large bursts within seconds strongly indicated automated tools or purchased referrals. For example, one of the top paticipant exhibited patterns where referrals surged unnaturally, suggesting bulk actions rather than genuine outreach. Also, this participants “bought invites” Such behavior went against the campaign’s principles of organic and authentic community growth.

While the Bankii Hive Campaign was promoted by our official ambassador, some participants misrepresented their collaborations or used improper methods to amplify their efforts.

Specifically:

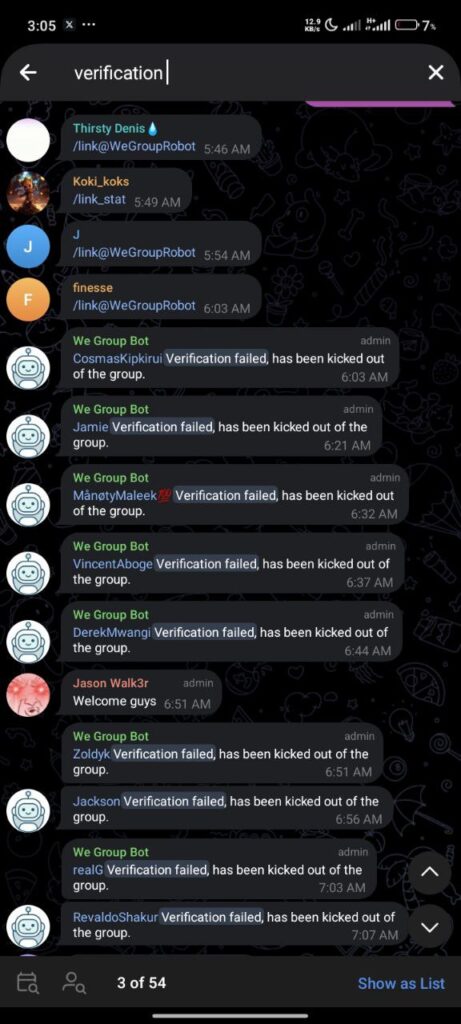

To maintain group integrity, a CAPTCHA system was in place to filter out bots and ensure only real users could join. A large portion of referrals tied to disqualified participants failed this verification, confirming the use of automated or non-human invites.

Bankii values an active and thriving community. Some participants invited members who joined the group but did not engage meaningfully. Others left shortly after joining, highlighting a lack of genuine interest. Referrals were only counted if the referred members participated in discussions or reacted to posts, ensuring quality over quantity.

Bankii’s mission is to build a community rooted in trust, authenticity, and shared values. Allowing fraudulent or manipulative actions to go unchecked would:

By enforcing the rules, we ensured that the rewards went to deserving participants who contributed meaningfully to our community.

The Bankii Hive is stronger than ever, with our community growing from 1,200 to over 4,000 members during this campaign. This milestone is only the beginning of what we’ll achieve together.

More campaigns, rewards, and opportunities to connect are on the horizon. Let’s continue building with integrity and enthusiasm. Together, we’re shaping Africa’s financial future.

Stay buzzing! 🐝

We appreciate the enthusiasm shown by all participants but had to take these measures to ensure fairness and the integrity of the campaign.

© Bankii. Availability of products and services may vary by geographic location and is subject to applicable terms and conditions. Bankii does not provide services to citizens of the Russian Federation or non-EU residents. Eligibility for specific products and services is determined at the discretion of Bankii. Rates for Bankii products are subject to change.

© All rights reserved. Made by Kariba