More freelancers than ever are choosing to get paid in cryptocurrency, and for good reason. In many regions, traditional banking systems are slow, expensive, or difficult to access. Crypto offers a faster, borderless alternative for receiving payments. And with crypto payments, there is no more waiting days, waiting for international wire transfers, or losing money to high fees.

Many freelancers prefer using crypto payments due to the efficiency it provides.

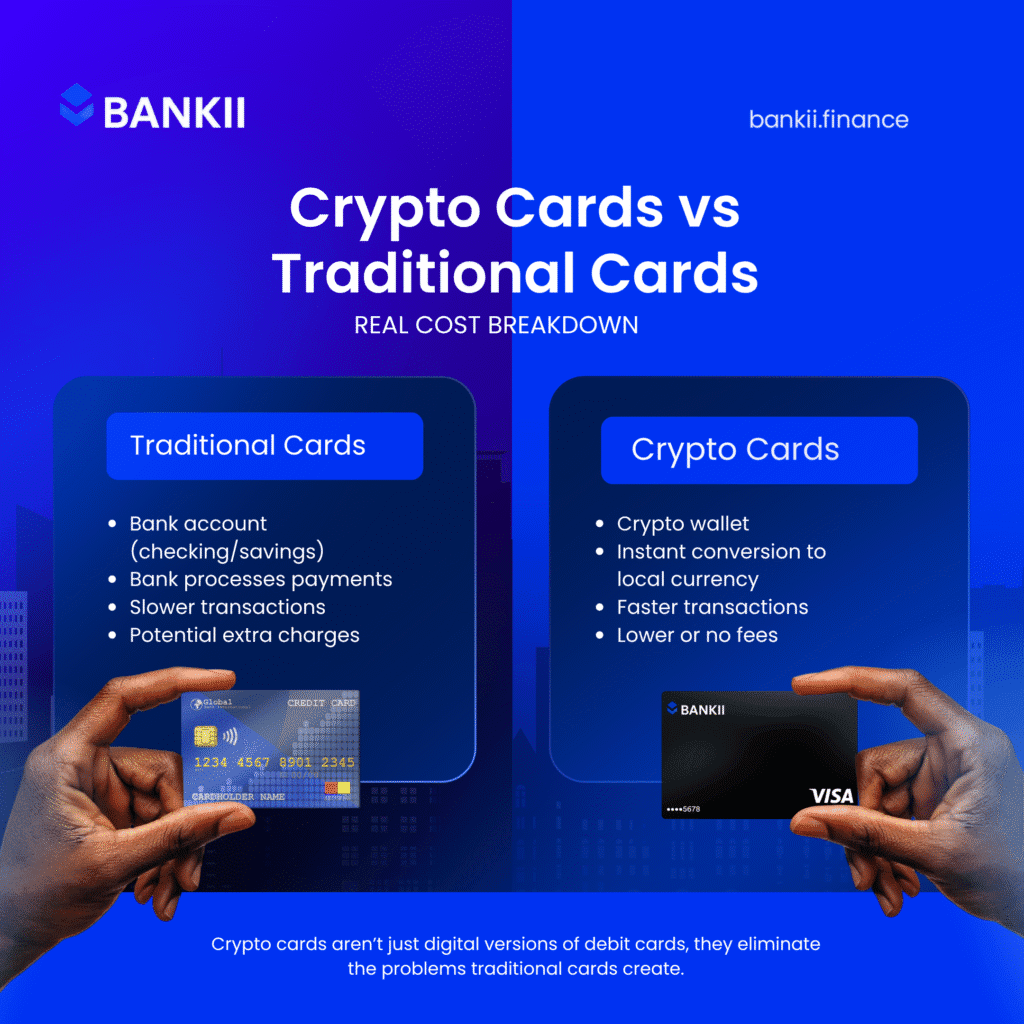

If you’re wondering how crypto compares to conventional methods in terms of fees and flexibility, check out this real cost comparison between crypto and traditional cards.

Understanding how to manage crypto payments is essential for maximizing your income.

But this brings up a key question for anyone earning in digital assets. Once the crypto payment lands in your wallet, how do you actually use it in real life?

The Rise of the Freelance Economy

Freelancing is no longer a niche lifestyle. It’s a global economic force. As of 2025, there are an estimated 1.57 billion freelancers worldwide, making up nearly 47% of the global workforce.

In the United States alone, 64 million people freelanced in 2023, contributing over $1.27 trillion to the economy. Around the world, freelance work is booming in regions like Southeast Asia, Latin America, Africa and Eastern Europe where cross-border payments, rising digital opportunities and flexible work are redefining the idea of employment.

Yet, for many of these workers, getting paid is still a challenge.

Crypto Payments Are Going Mainstream, Especially for Freelancers

With the growth of crypto payments, freelancers can enjoy greater financial freedom.

Crypto adoption is accelerating worldwide, and it’s no longer just about investing. As of mid-2024, more than 562 million people own cryptocurrency, making up roughly 6.8% of the global population. What started as a speculative asset has evolved and today, the spotlight is on crypto’s real-world utility.

In many cases, crypto payments can be converted easily for everyday use.

For the fast-growing freelance workforce, cryptocurrency payments for freelancers are becoming a go-to method for receiving fast, low-fee international payments. But until recently, there was one major gap:

How do you actually spend the crypto you earn? With the rise of crypto debit cards and payment platforms, freelancers can now use crypto for everyday transactions, bridging the gap between blockchain earnings and real-world spending.

This is why understanding the mechanics of crypto payments is crucial.

The Problem with “Getting Paid”

Efficient management of crypto payments can lead to significant savings.

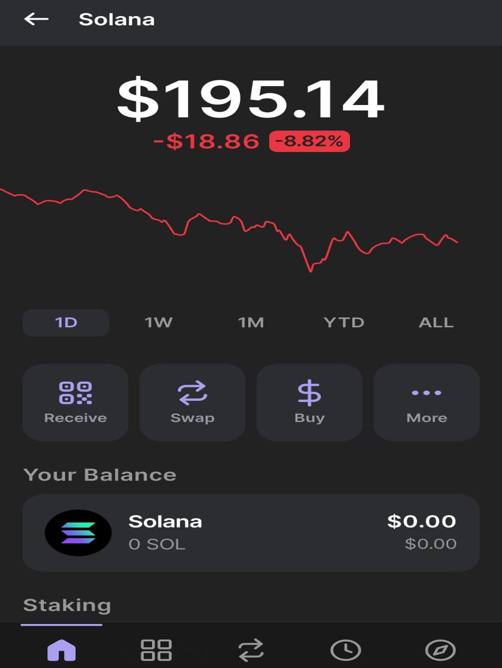

Getting paid in crypto as a freelancer is only half the equation. To actually use those earnings, many freelancers still rely on converting digital assets into local currency via crypto exchanges. That often means transferring funds to a bank account and waiting several days for the money to clear.

This process is slow, costly, and sometimes completely unavailable, especially in regions with limited banking access or unstable financial systems. For freelancers working internationally, it creates a frustrating bottleneck between earning and spending.

A Smarter Way to Spend

Today, new tools are making it easier than ever to skip the delays and spend crypto directly.

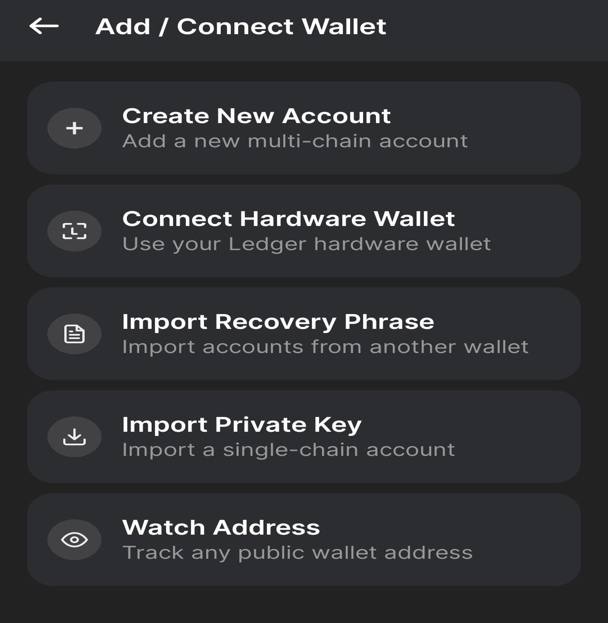

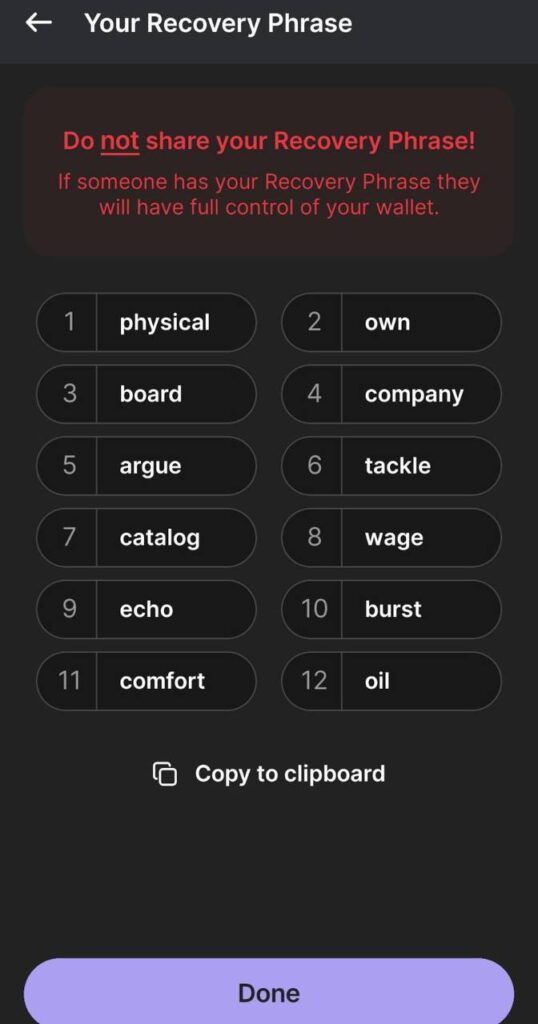

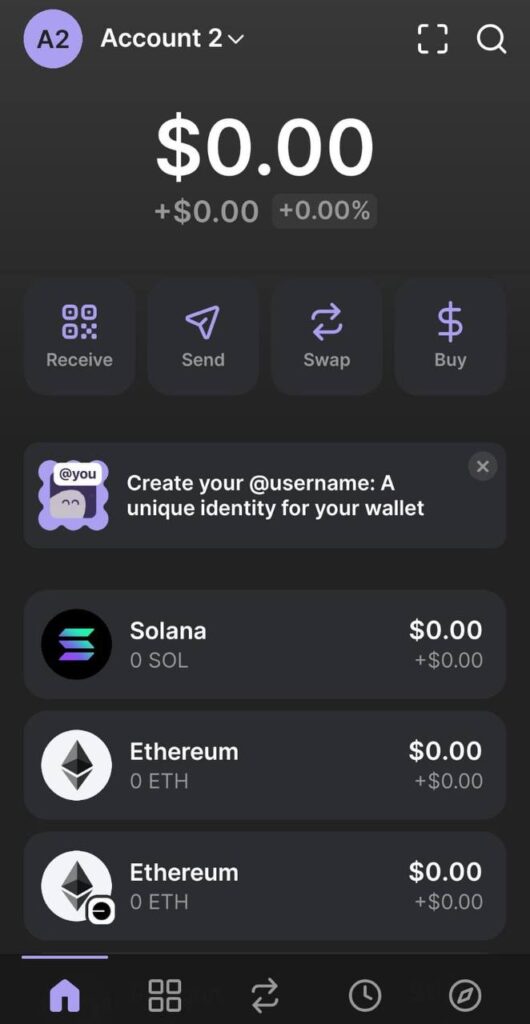

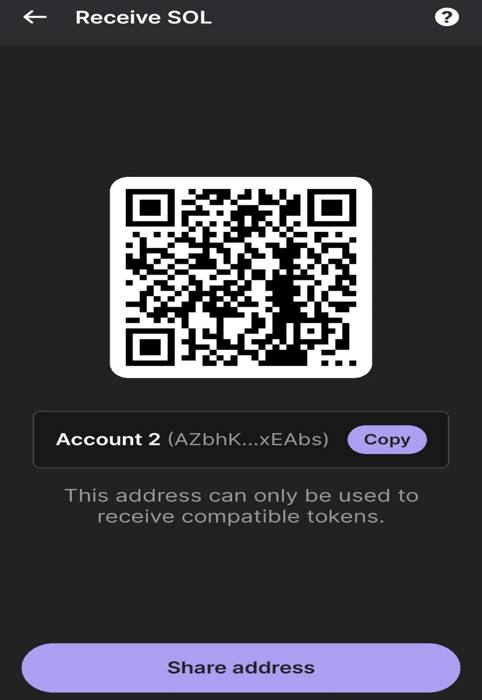

Some modern wallets now come with integrated virtual or physical cards that connect directly to your crypto balance. This allows you to pay for tools, subscriptions, everyday expenses and even groceries without needing to convert your funds first.

Platforms like Bankii bring all of this together. With a Bankii card, you can:

- Receive crypto payments from clients globally

- Hold and manage funds securely in stablecoins or crypto

- Spend instantly online or in stores through Visa

Using crypto payments can significantly reduce transaction costs. As more people adopt crypto payments, the ecosystem continues to evolve. No more multiple apps. No waiting periods. Just fast, usable money in your control. The convenience of crypto payments is changing the landscape for freelancers. Understanding the benefits of crypto payments will help freelancers thrive. Ultimately, embracing crypto payments can lead to a more prosperous freelance career.

Why This Matters

Freelancers often face delays with cross-border payments, and traditional banking systems don’t always meet their needs. Crypto offers a faster, borderless solution.

With over 1.57 billion freelancers worldwide, the demand for flexible, global payment tools is rising fast. Being able to spend directly from your crypto wallet means fewer delays, lower costs, and more control, no bank required.

The Takeaway

The freelance economy is huge and growing fast. So is crypto adoption. Together, they are reshaping how people earn, move and spend money across the world. Whether you’re a developer in Brazil, a writer in Kenya or a designer in Poland, earning in crypto and using it without friction is no longer a dream. It’s the new standard.

Platforms like Bankii are helping to make this future real, offering a smarter, faster and more global way to manage your freelance income.

Stay tuned. This is just the beginning.